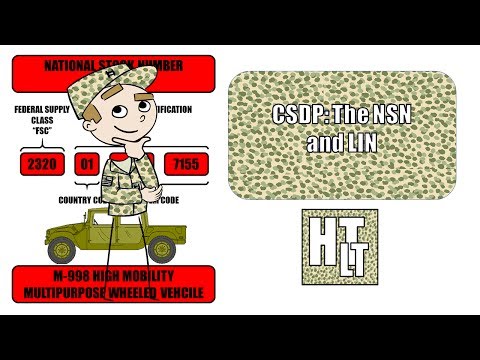

I assure you that today's video will be very entertaining. Tales of suspense and bravery, heroism and okay, well, I know supply is dry and for the next few weeks, it's gonna be boring. You can't really make stock record accounting and categorize them very sexy. Well, like visiting SRP, let's get the injections done so that we don't have to suffer the illness of flipple or statements of charges. The US military has quite a few types of codes and categorizations to describe supplies and how to handle them. You will not use most of them or if you do, it won't be until later in your career. Things like the controlled item inventory code, the property book identifier code, and the end item codes can become important, but usually not until you're in command or acting as an XO. The two codes that you're more likely to use are the national stock number known as the NSN or the line item number or the lid. The NSN is a code that predictably is filled with other codes. It is analogous to a person's social security number in that it is the base identification number for an item. It is used by nearly every system the army has to get information about the item or to requisition it. It is made up of 13 digits split up into two parts. First is a federal supply class. The FSC is the first four digits corresponding to a set of supplies or equipment. For example, FSC 2320 will cover most trucks. This number can become important when determining how to account for certain items, but generally, it is just used to help categorize equipment. The last nine digits of the NSN is the national item identification number. Within the Ninh, there's...

Award-winning PDF software

Sub Hand Receipt regulations army Form: What You Should Know

It is the responsibility of the recipient to determine if a particular item or category of items is to remain unexpended and noncanceled.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form Da 2062, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form Da 2062 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form Da 2062 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form Da 2062 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sub Hand Receipt regulations army